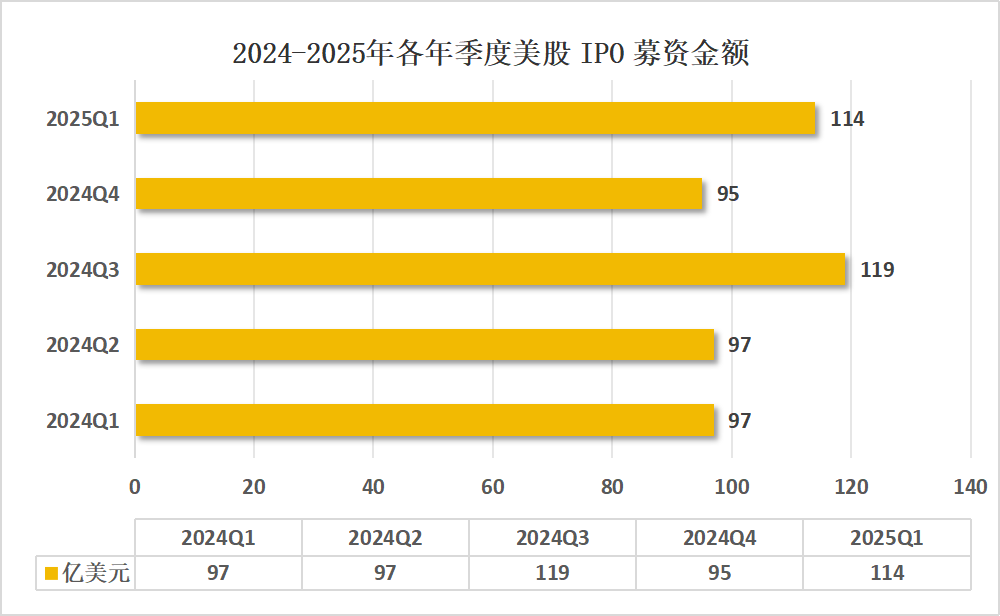

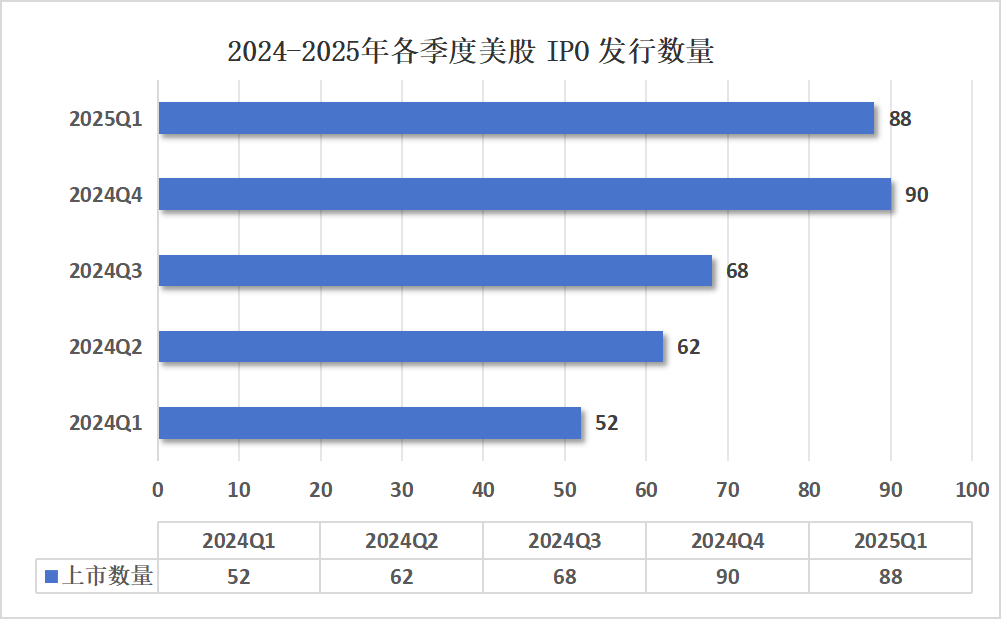

In the first quarter of 2025, the US IPO market showed a remarkable recovery trend. The number of offerings reached 88, an increase of 36 compared to the same period last year. In terms of financing, the amount raised through IPOs in the first quarter was $11.4 billion, representing a 17.52% growth compared to the same period last year.

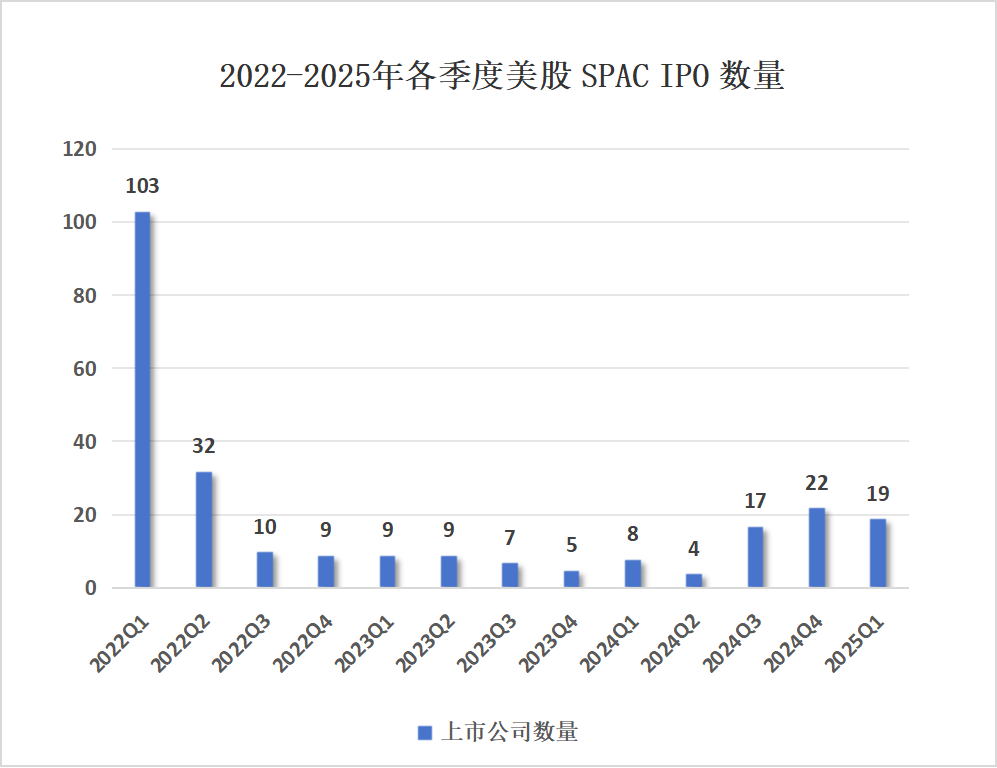

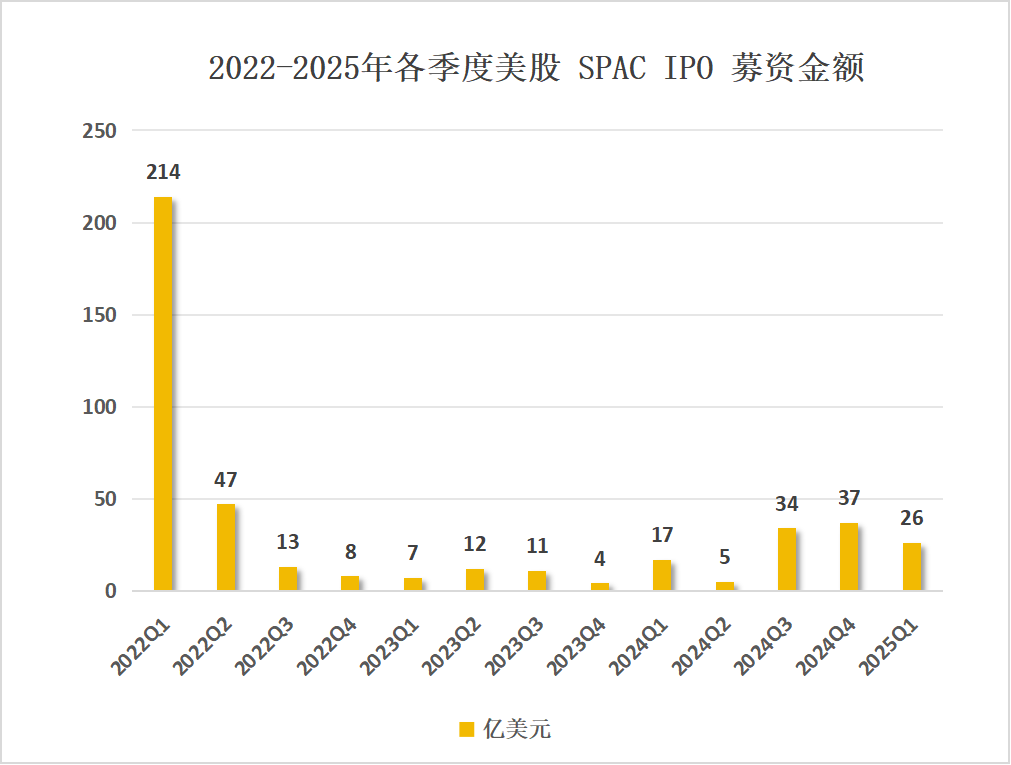

II. The Number of SPAC IPO Offerings and Financing Scale in the US Stock Market

The US SPAC market was very active in the first quarter of 2025. A total of 19 companies successfully went public, an increase of 11 compared to the same period last year. In terms of fundraising, SPACs raised $2.6 billion in the first quarter, a significant year-on-year increase of 52.94%. Currently, under the US stock market environment, the market popularity of the SPAC model continues to recover.

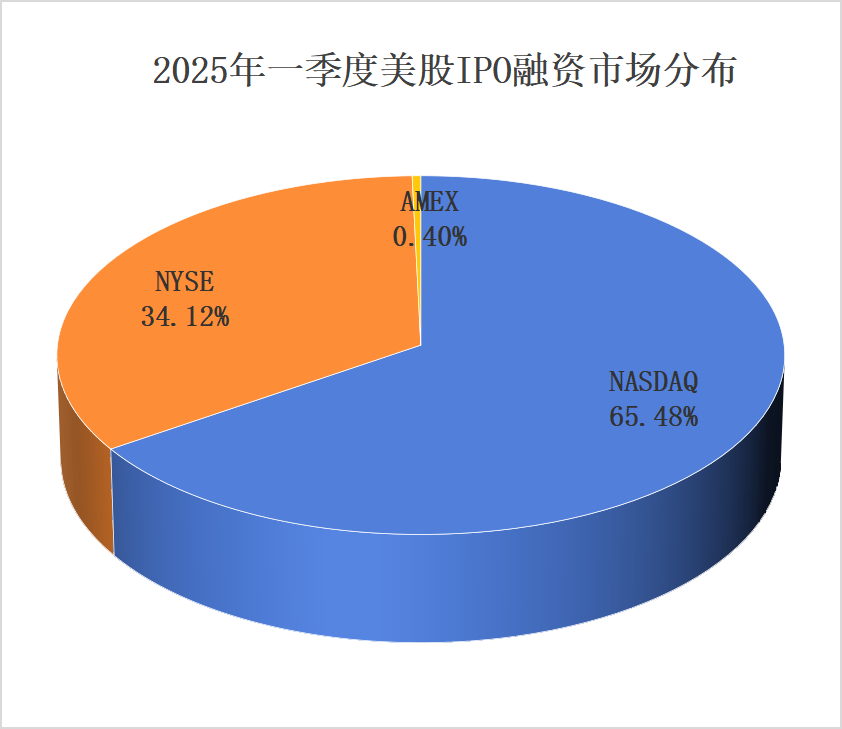

III. IPO Market Distribution

In the first quarter of 2025, the NASDAQ remained the exchange with the largest number of IPOs in the U.S. stock market, with 73 companies going public and raising $7.472 billion, accounting for 65.48% of the total U.S. IPO financing scale. The New York Stock Exchange (NYSE) saw 10 IPOs, raising $3.893 billion (34.11% of the total), while the American Stock Exchange (AMEX) had 5 listings, raising $46 million.

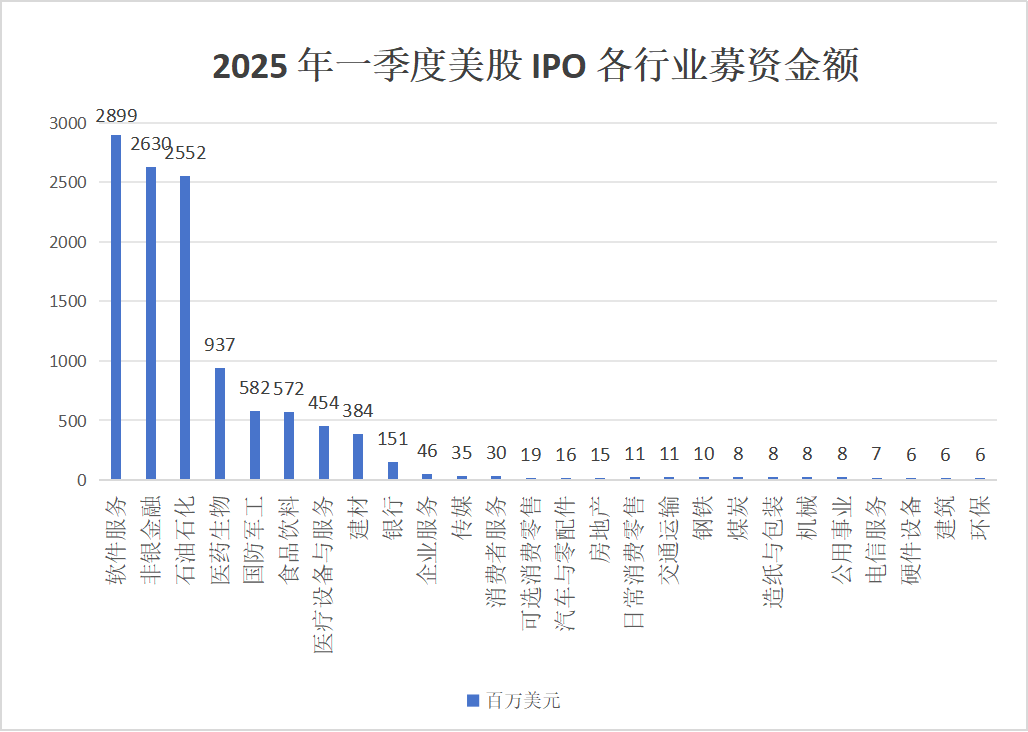

IV. Industry Distribution of IPO Listed Entities

In terms of the industry distribution of listed entities, the software services industry led IPO financing in the first quarter of 2025, raising $2.9 billion. The non-bank financial industry and the petroleum and petrochemical industry tied for second place, each raising $2.6 billion.

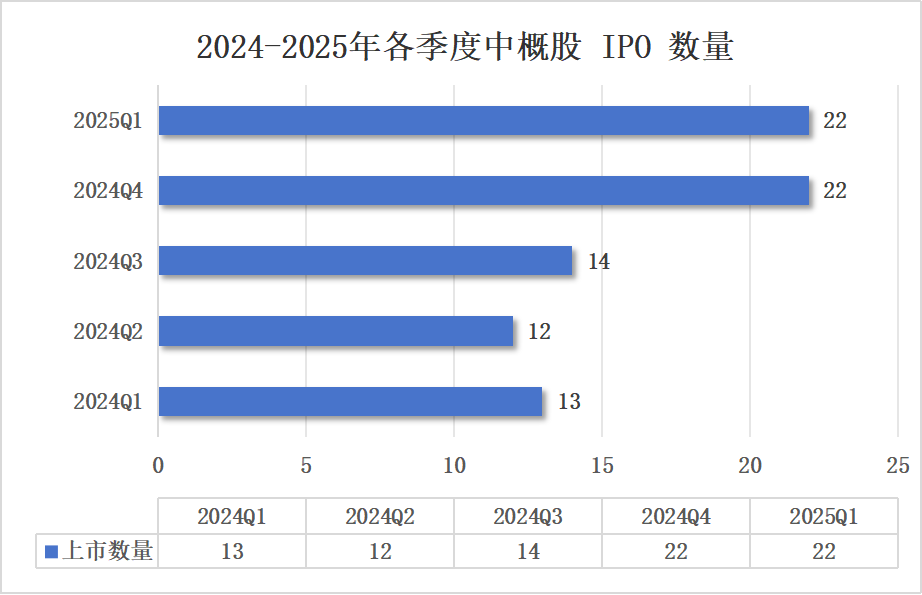

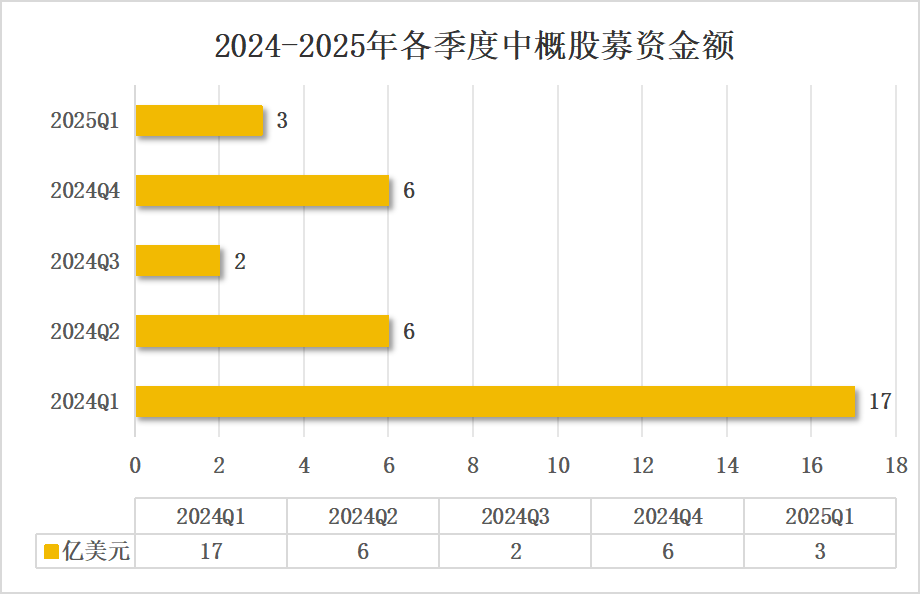

V. The Number of Chinese Concept Stock IPO Offerings and Financing Scale

In 2025, Chinese concept stocks continued to maintain a positive trend in listing on the U.S. market. In the first quarter, a total of 22 Chinese enterprises successfully listed in the U.S., an increase of 9 compared to the same period last year, indicating a significant rise in market activity. The total financing scale reached $300 million, a year-on-year decrease of 82.35%, among which Asymchem Laboratories raised as much as $126 million.

In this quarter, 2 Chinese concept stocks successfully listed in the U.S. through SPAC mergers: Femco Steel Technology Co (Qikun Technology) with a valuation of $400 million and Chongqing Haohan Gamehaus Inc with a valuation of $500 million.

Compared with 2024, the U.S. stock market has shown a higher acceptance of IPOs, with the number of Chinese concept stocks listed in the U.S. increasing actively, and the industry distribution and the number of listed companies continuing to grow. It is expected that the U.S. stock market will remain highly active in the coming months.

The Overseas Listing Capital Group for Small and Medium Enterprises will continue to provide more overseas listing consultations for partners and friends, and looks forward to cooperating with you!

关注官方微信

关注官方微信