SPAC (Special Purpose Acquisition Company)

What is the basic logic of SPAC listing?

SPAC (Special Purpose Acquisition Corporation), also known as "SPAC platform", is an approach of being listed that originated in the U.S. capital market. SPACs are referred to as "shell companies" or "blank check companies" in the industry, and their purpose is to acquire a high-quality target company in the future and make it a publicly traded company quickly.

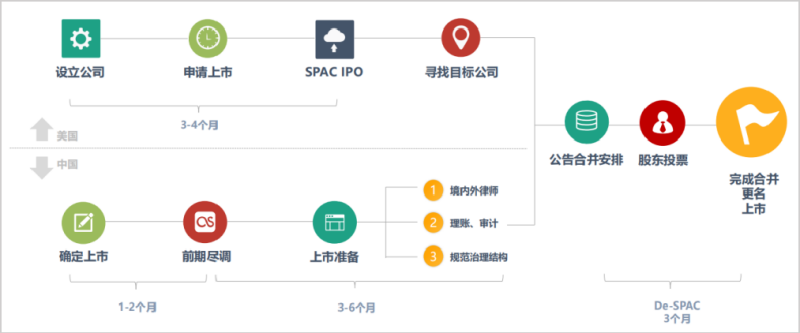

What are SPAC's processes and innovations?

SPACs are usually established by experienced management teams or sponsors with a certain amount of capital, and they usually file an application with the SEC to raise capital in an IPO. SPAC is an another listing method that is different from the traditional IPO and “back-door listing”. Its innovation is that instead of buying a shell, it first forms a shell company for launching IPO, and then conducts M&A to finally generates a new listed company. The SPAC mode is characterized by fast time, low cost, simple process and guaranteed financing, which is a great advantage for both investors and target companies.

What are the specific advantages of SPAC?

Certainty of listing. SPAC must complete the acquisition within a specified period of time. F or the acquired target company, it can go public as long as the corresponding conditions are met and the merger is completed, so there is certainty of listing; Flexible valuation The issue price of the new company is subject to negotiations between the target company and SPAC management, while a traditional IPO is more influenced by the market environment. Financing is guaranteed SPAC has raised tens of millions of dollars from investors, and upon completion of the reverse merger with SPAC, the target company can go public and obtain financing at the same time.

Short time, low cost and “grow together on the same boat” After the merger and listing, the two parties are a family and a community of interests.

The SPAC process and timeline

关注官方微信

关注官方微信