Throughout the global capital market, it is subject to varying degrees of macro influences such as geopolitical conflicts. In this economic context, Nasdaq has surpassed the New York Stock Exchange with 35 new shares and $11.84 billion in the global new stock ranking with 87 new shares and $14.53 billion, mainly due to its successful completion of the world's largest new share issuance to date. In the future, the number of IPOs and financing amounts for small and medium-sized enterprises are expected to continue to rise, becoming the "main force" in the US capital market.

Recently, with the slowdown of A-share new stock issuance, interest rate cuts by the Federal Reserve, and the introduction of relevant policies supporting domestic companies to go public overseas, these influencing factors will attract more Chinese companies to go public in the United States, especially those from the technology industry. In the first three quarters of 2024, there will still be a significant increase in the number of Chinese companies going public in the United States, and the scale of new stock financing is mostly in the millions of US dollars. The US stock market will become another popular choice outside the domestic market.

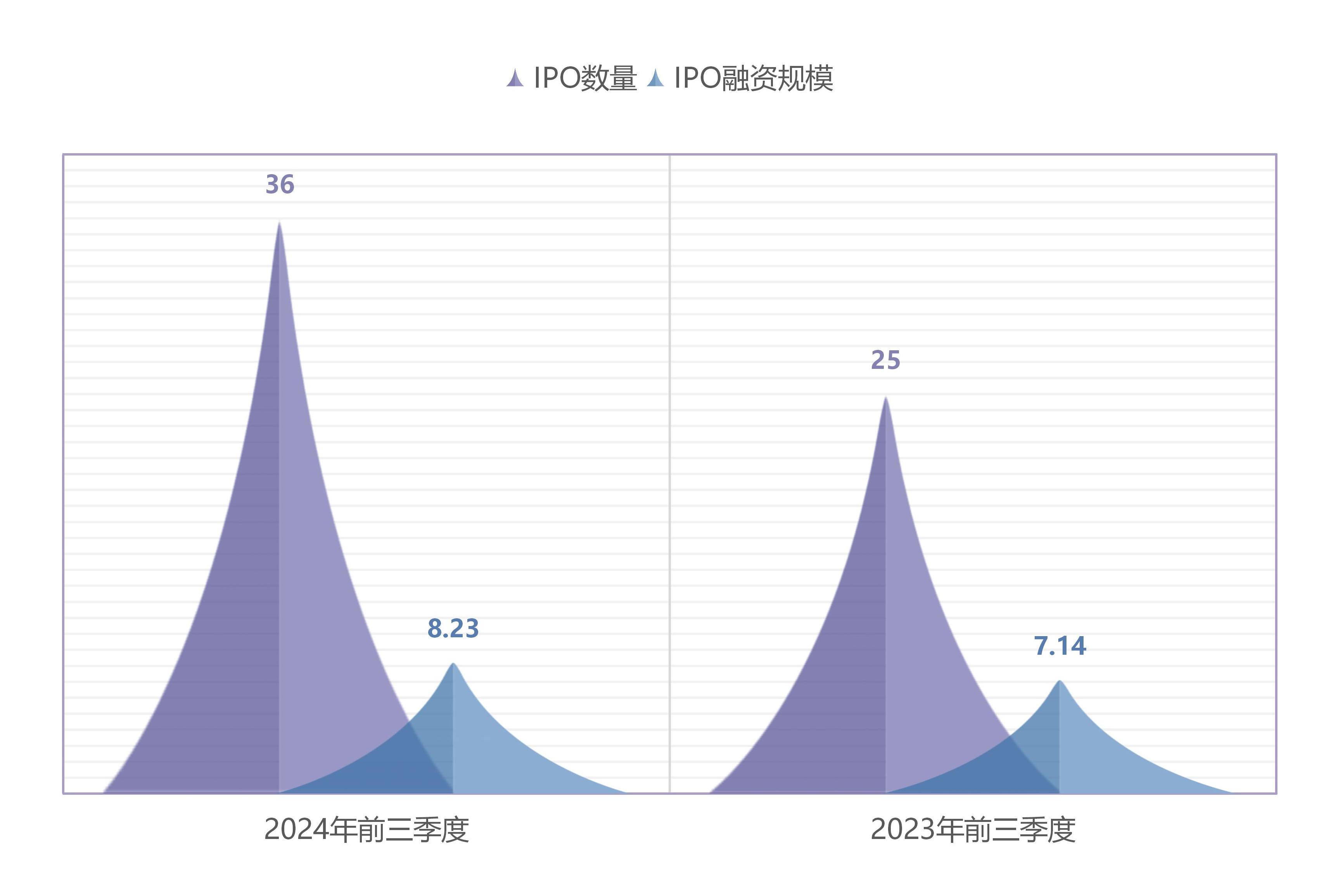

IPO issuance quantity and financing scale (in billions of US dollars)

In the first three quarters of 2024, the number of IPOs and financing scale of Chinese concept stocks going public in the United States increased by 44% and 15% respectively compared to the same period last year.

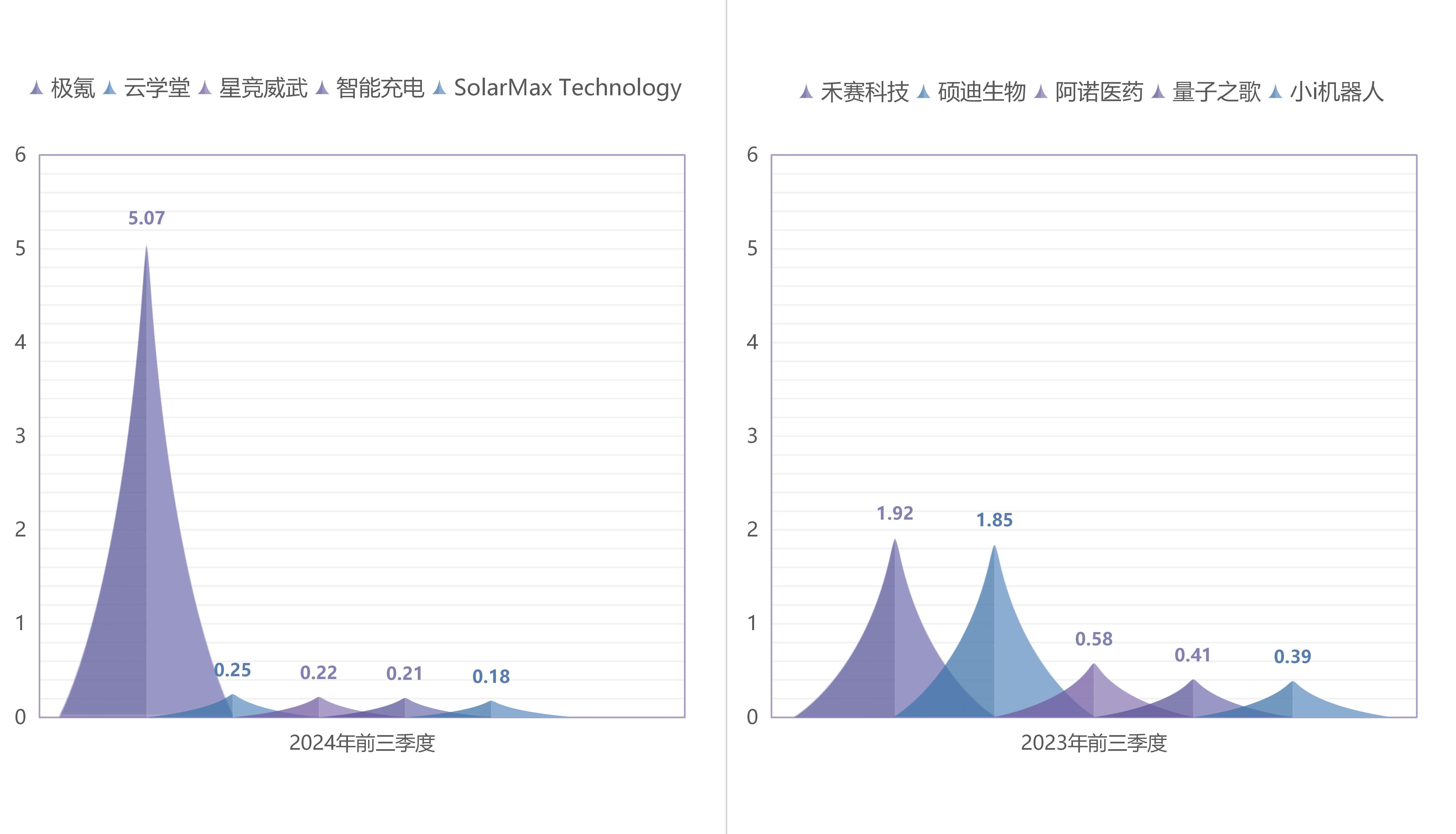

Overview of the Top Five IPO Financing Sizes (in billions of US dollars)

In the first three quarters of 2024, the total financing scale of the top five IPOs was $593 million, an increase of 15% compared to the same period last year when it was $515 million.

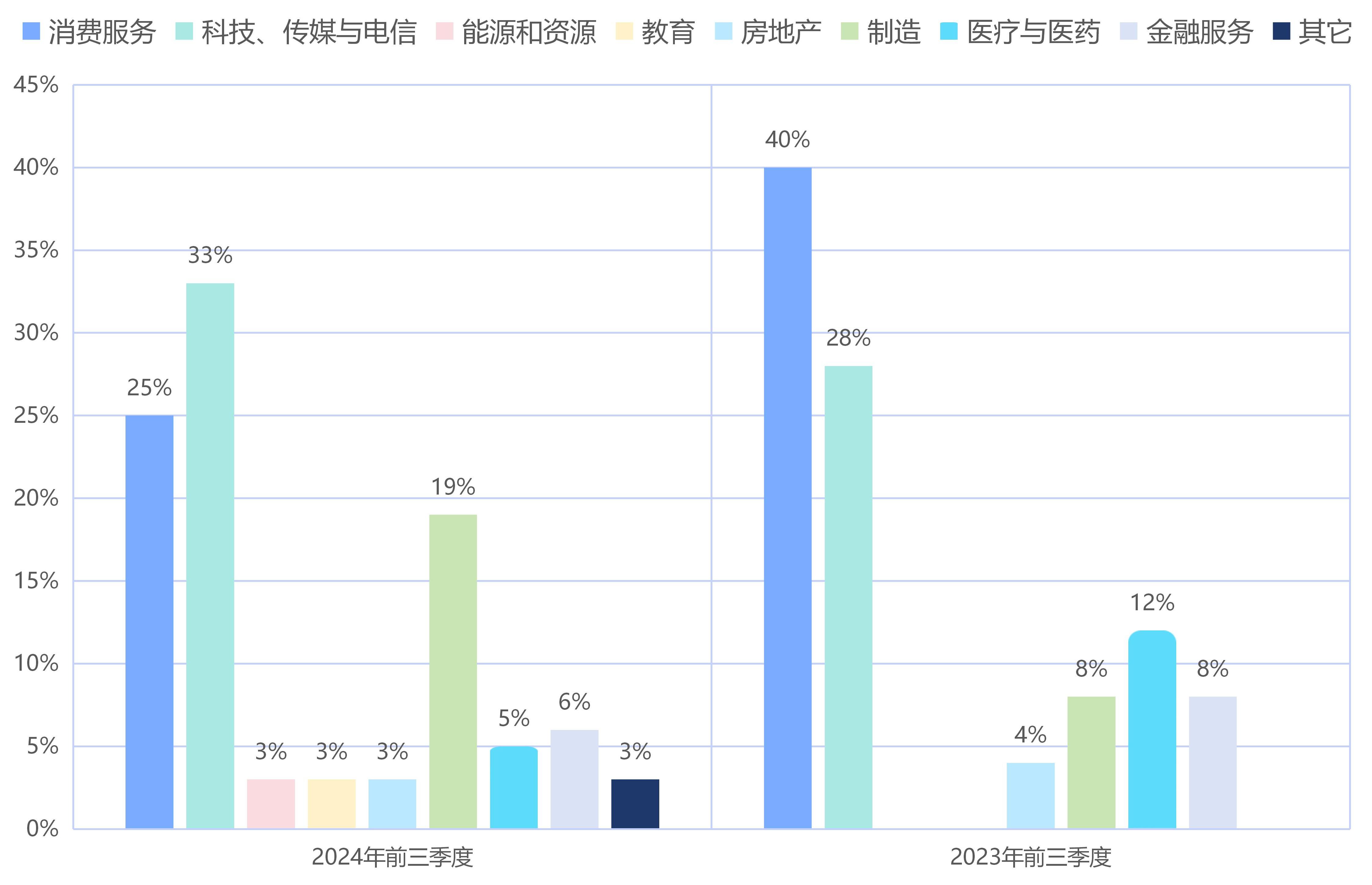

Proportion of IPO industry(by quantity)

In the first three quarters of 2024, the technology, media, and telecommunications industry (TMT industry) led the way, while the consumer services industry ranked first in the same period last year.

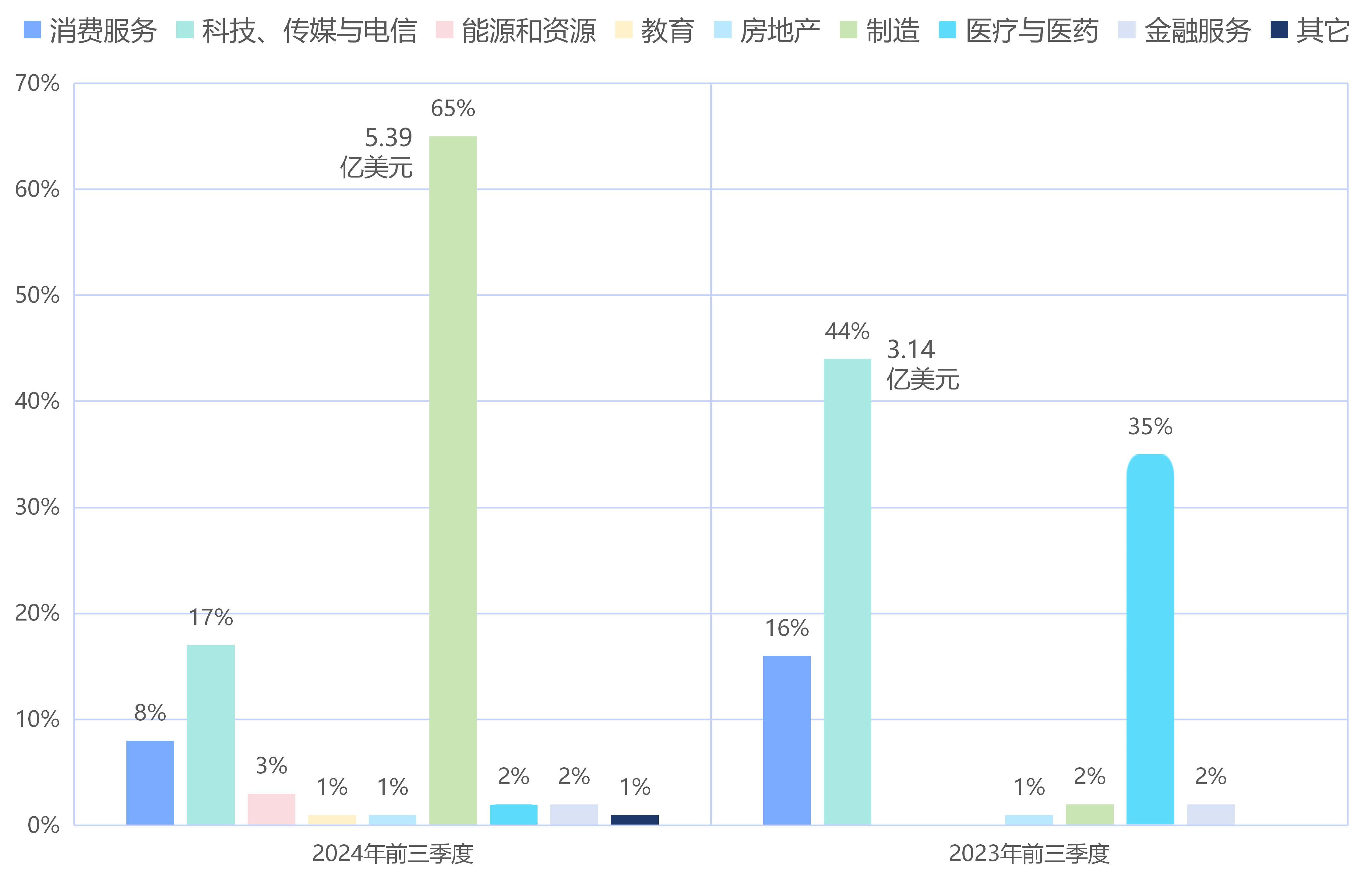

Proportion of IPO industry (Calculated by financing amount)

In the first three quarters of 2024, the manufacturing industry led with a financing amount of $539 million accounting for 65%, while the TMT industry led with a financing amount of $314 million accounting for 44% in the same period last year.

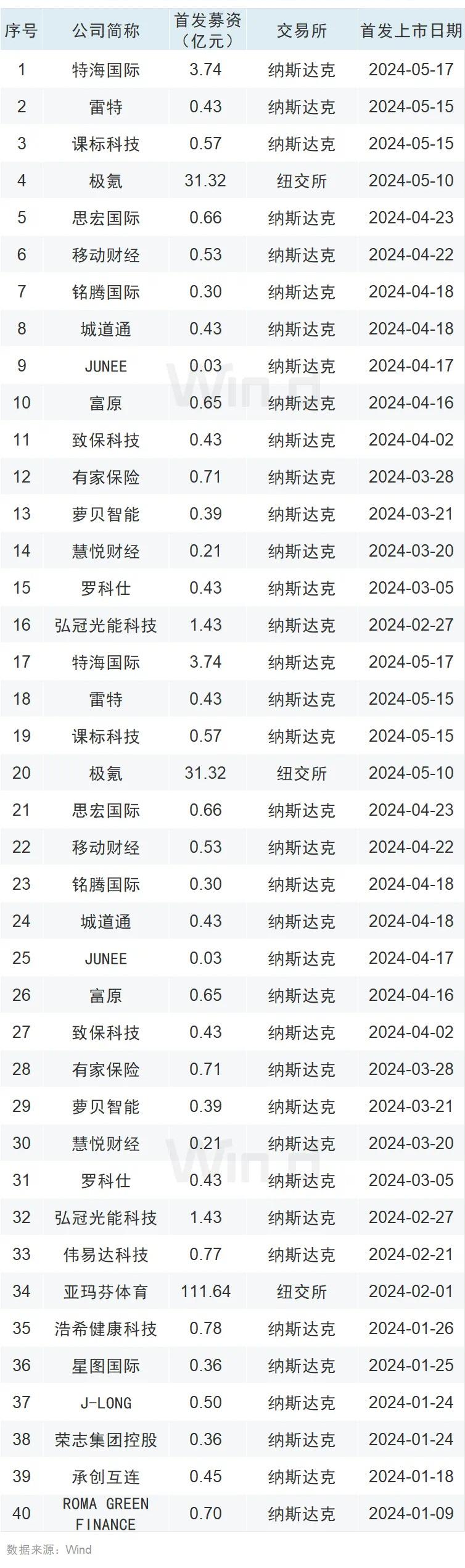

List of Chinese funded enterprises listed overseas in the first three quarters of 2024

Data sources: New York Stock Exchange, NASDAQ, Bloomberg, Refinitiv, Deloitte, Wind Data

The Overseas Listing Capital Group for Small and Medium sized Enterprises is committed to helping more small and medium-sized enterprises in Asia go public in the United States. As early as 2009, it began using SPAC reverse mergers and acquisitions to help companies go public in the United States. Today, it has 15 years of mature experience and many successful cases. In recent years, SPAC listing has also become a popular choice for a large number of small and medium-sized enterprises to go public overseas. We have sufficient high-quality SPAC shell resources, and we believe that with our professional, focused, and persistent attitude, we can help more small and medium-sized enterprises go public in the United States faster and smoother. We look forward to working with you!

关注官方微信

关注官方微信