Grayscale Ethereum Trust (ETH) (Trust Fund) (NYSE Arca: ETHE)

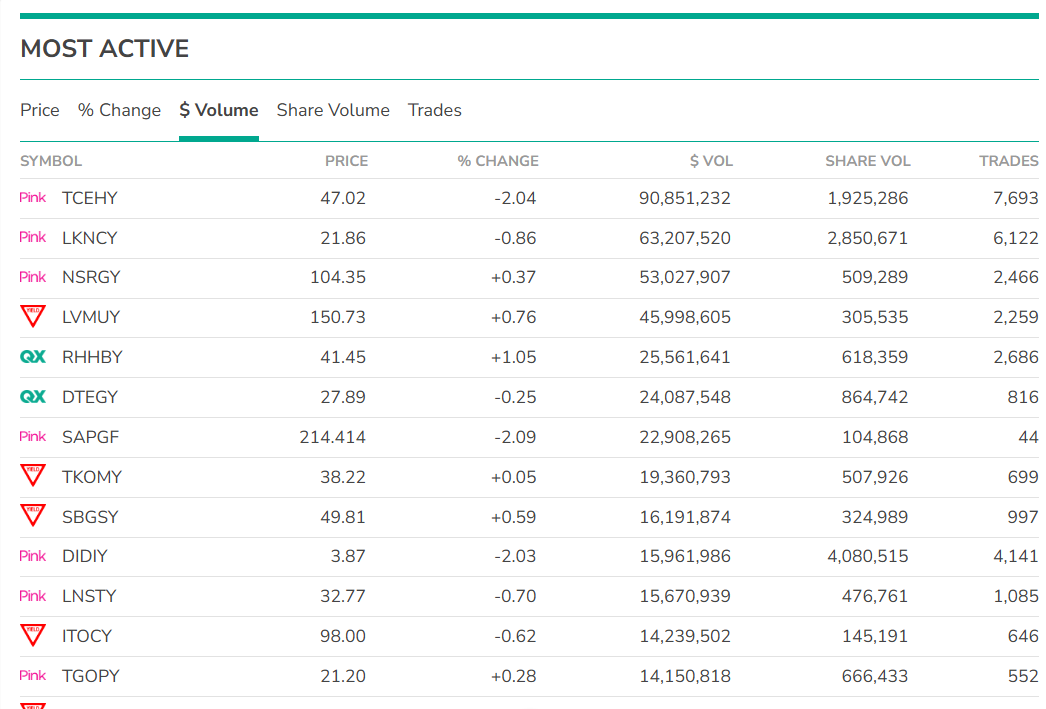

The OTC market in the United States was active in July, far surpassing the New Third Board, the Beijing Stock Exchange, and the Hong Kong Growth Enterprise Market. Globally, the US capital market is still the first choice for many companies to go public for financing. The OTC market in the United States was established in 1913 and has a history of more than 100 years. In addition to its long history and mature market, it also has many advantages such as loose listing standards and low listing maintenance costs. At the same time, OTC often serves as a "transit station" between the New York Stock Exchange and Nasdaq, attracting a large number of companies to go public. In July alone, four companies successfully upgraded to the main board market of the New York Stock Exchange/NASDAQ, which proves that the OTC market is indeed a good "breeding ground" for the New York Stock Exchange/NASDAQ main board market.

And the United States has always been the center of the global capital market. Choosing to go public in the United States can greatly increase a company's exposure and visibility, thereby promoting better internationalization. Even well-known international companies such as Tencent, Louis Vuitton, Nestle, Deutsche Telekom, Didi, Luckin Coffee, etc. still choose to list on the OTC market.

The overseas listed capital group for small and medium-sized enterprises is jointly established and initiated by well-known institutions and professionals such as the United Business Association and the Wall Street Listing and Financing Office in the United States. The group has provided professional financial services such as project financing and capital solutions to numerous small and medium-sized enterprises in the Asia Pacific region. After the 2008 financial crisis, it became the first professional IPO coaching institution in China to engage in SPAC. And it has been deeply cultivated until now, accumulating 15 years of mature experience.

The group has a large number of high-quality SPAC shell resources and OTC shell resources. Enterprises can choose to list on the OTC market or the main board market through SPAC listing or the "OTC two-step" listing method based on their actual situation. Regardless of which method is used, the group can provide personalized one-stop services to fully help enterprises enter the offshore capital market more efficiently. We look forward to working with you!

关注官方微信

关注官方微信