According to the prospectus, on July 12, 2024, as a pioneer in the advanced use of hydrogen for research and development, manufacturing, and sales of hydrogen powered vehicles, HUURE announced that they have signed a final merger agreement with Aquaron Acquisition Corp. (NASDAQ: AQU), a publicly traded special purpose acquisition company, which will operate HUURE under a holding entity called HUURE Group Limited. HUURE Group Limited is an exempt company registered in the Cayman Islands ("Pubco") and plans to trade on the NASDAQ stock market. The proposed transaction reflects an initial equity value of approximately $1 billion.

HUURE was founded in 2020 and is a leading hydrogen powered vehicle manufacturing company in China. Xiao Hydrogen Automotive (Shanghai) Co., Ltd. is a wholly-owned subsidiary of FUTURE, which operates a hydrogen powered vehicle research and manufacturing plant in Shanghai with its rich industry experience. HUURE has a team of experienced engineers and technicians with extensive work experience in well-known automotive manufacturing companies. Based on the professional capabilities of the existing team, HUURE aims to expand its research and development and manufacturing capabilities, and further commit to sustainable and environmentally friendly transportation solutions.

Mr. Chen Weishan, founder and chairman of FUTURE, said, "We are pleased to announce this important milestone for FUTURE. This transaction will enable us to accelerate our growth strategy, expand our market share, and enhance our ability to provide comprehensive solutions to customers in the hydrogen powered vehicle market. With our core expertise in hydrogen powered vehicle research and development, manufacturing, and sales, we are in a favorable position to fully leverage the growing demand for environmentally friendly transportation solutions. We look forward to working closely with new partners and investors to achieve our long-term goals

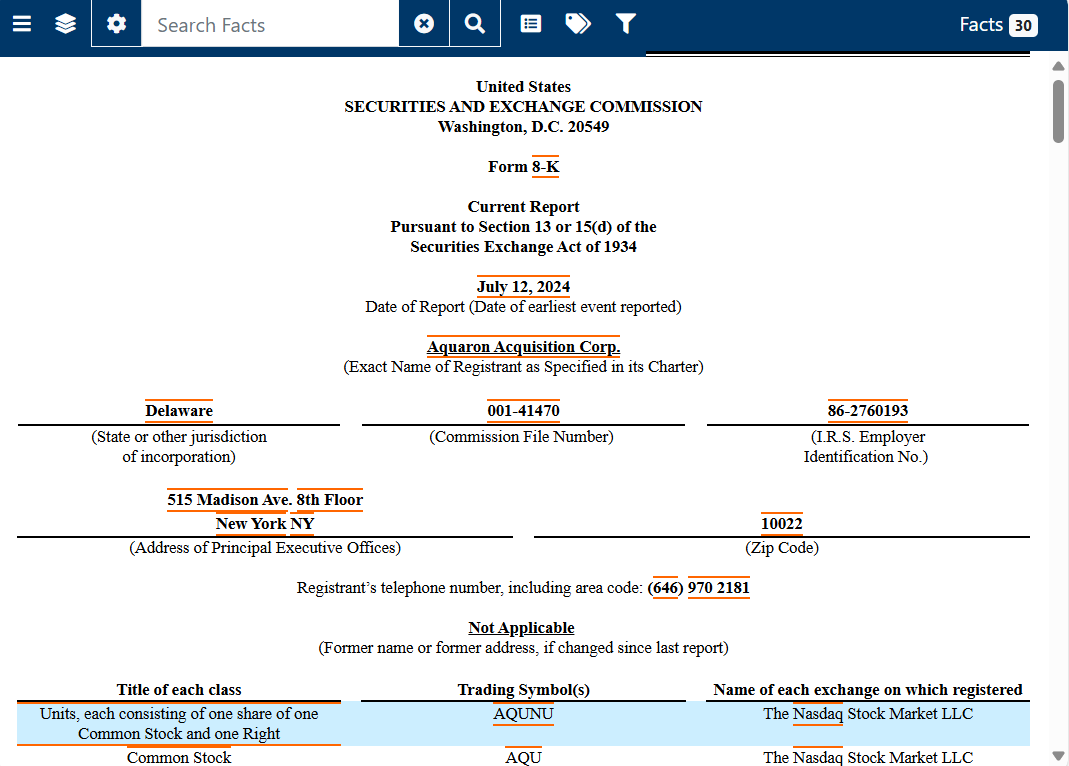

We are proud to be a partner of FUTURE, and completing our business merger is a huge step forward, "said Ms. Zhou Yi, CEO and Chairman of Aquaron Acquisition Corp.

In China, hydrogen energy is an emerging industry, and the scale of industry enterprises is generally small and the financial strength is relatively weak. However, hydrogen energy is a key development direction for China's emerging and future industries. For enterprises, the focus is on where to go and how to go public for financing in order to better adapt to the times.

The hydrogen energy industry is in an emerging stage of development, and domestic valuation standards are not yet mature. Therefore, some companies are beginning to seek a "new way of IPO" - SPAC (Special Purpose Acquisition Company), in order to enter the US stock market.

SPAC can be traced back to the 1990s and has been settled in the United States for over 20 years. Today, it has become a very mature listing model. And the SPAC listing financing method is equivalent to integrating the characteristics and purposes of financial products such as direct listing, overseas mergers and acquisitions, reverse mergers, and private equity, and optimizing the features of each financial product, so that enterprises can better achieve their financing goals. SPAC is a popular way for small and medium-sized enterprises to obtain financing and go public, which is both fast and relatively low in threshold.

In addition, the capital market in the United States has a huge pool of funds, and small and medium-sized enterprises with good development prospects can often win the favor of American investors and obtain good corporate valuations.

Since 2009, the Small and Medium sized Enterprise Overseas Listing Capital Group has been using SPAC, a reverse merger model, to help small and medium-sized enterprises go public overseas. We are committed to providing professional and strong information support for the companies we cooperate with, helping them to quickly and smoothly go public overseas. Looking forward to working with you!

关注官方微信

关注官方微信