In the global

climate problem is increasingly contradictory today, China and other countries

have put forward the "carbon neutral" theme, fuel vehicles as one of

the main sources of carbon emissions, the promotion of electrification is

undoubtedly "carbon neutral" vision of great significance.

The New Energy

Vehicle Industry Development Plan (2021-2035) issued by the General Office of

the State Council of China states that pure electric vehicles will become the

mainstream of new sales vehicles by 2035. Starting from 2017, the global new

energy vehicles began to grow at a high rate, and in 2023, more than 10 million

vehicles; according to the type of power, pure electric accounted for about

73%. According to the International Energy Agency's forecast in China, the

European Union and the U.S., the average share of electric vehicles in total

vehicle sales is expected to rise to about 60% by 2030. Driven by Chinese

exports of new-energy vehicles, overseas consumers' awareness of Chinese brands

is gradually climbing, which will further promote the internationalization of

Chinese own brands, and it is expected that Chinese carmakers will occupy

several seats among the top 10 carmakers in terms of global sales in 2030,

according to Mingyu Guan, a managing partner at McKinsey & Company.

on February 23, 2023, Luxury electric vehicle maker Lotus Tech completed a merger with SPAC L

Catterton Asia Acquisition Corp, completing an $880 million financing through a

public equity private investment (PIPE) conversion bond, and listing on the

NASDAQ in the U.S. under the ticker symbol "LOT". On the first day of

listing, Lotus' intraday share price once surged to $17.99, closing at $13.8,

up 2.15%, with a total market capitalization of up to $9.294 billion (about RMB

66.874 billion), much higher than the previous valuation of $5.4 billion. The

Lotus IPO is not only the largest financing obtained by way of SPAC listing so

far in 2023, but also the largest IPO of Chinese stocks in the past 32 months.

Lotus, which was

acquired by China's Geely Group in 2017, is a world-famous sports car and

racing car manufacturer, and as a veteran British luxury sports car company, it

is known as one of the world's top three supercar brands along with Ferrari and

Porsche.

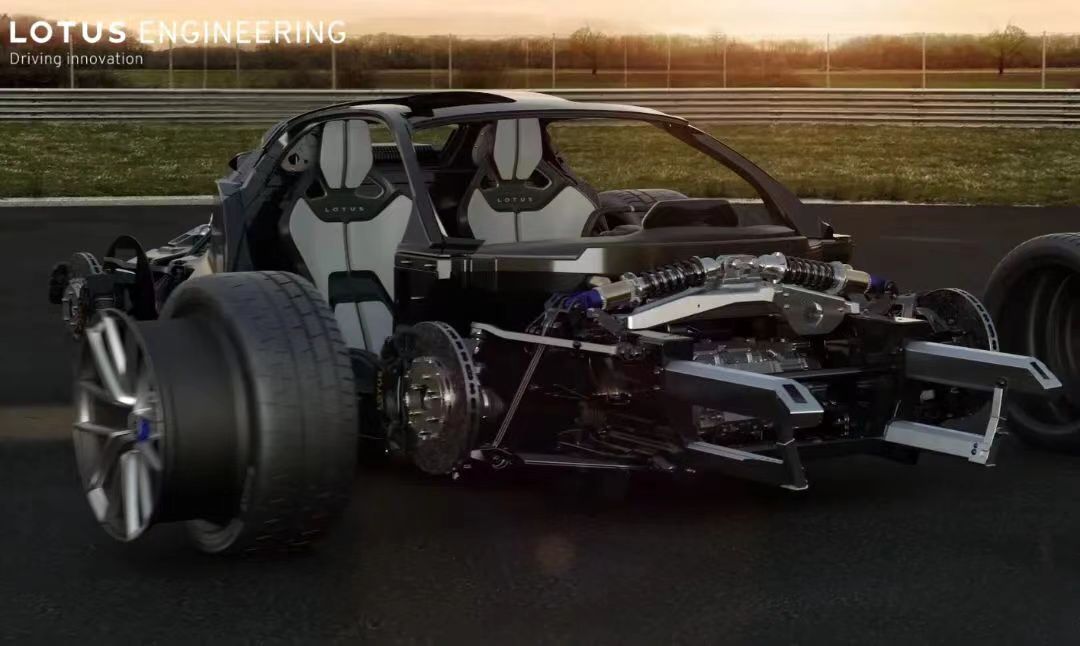

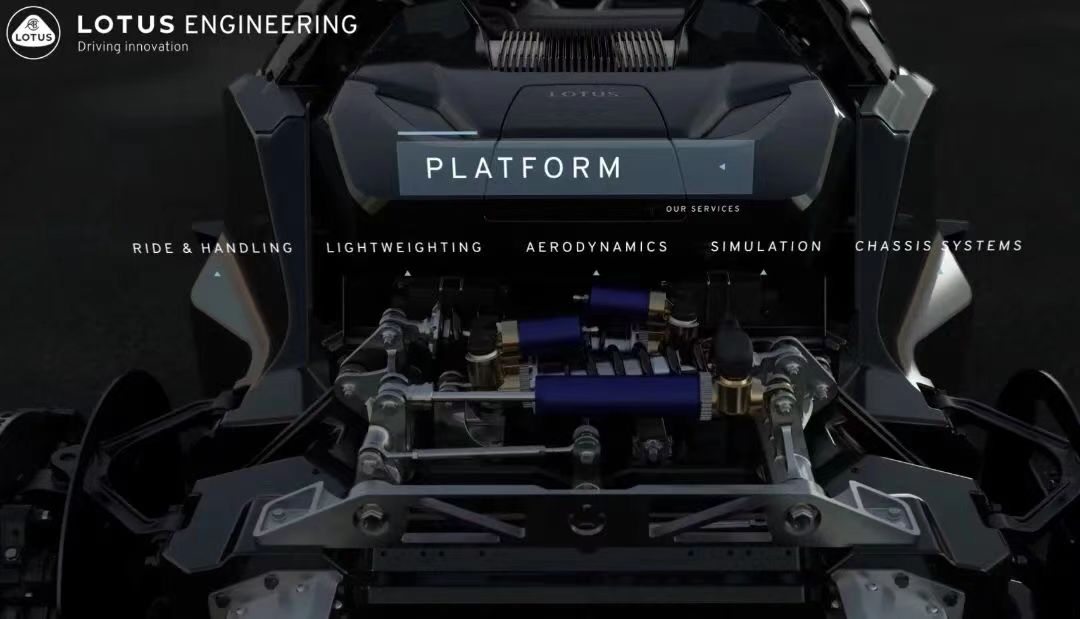

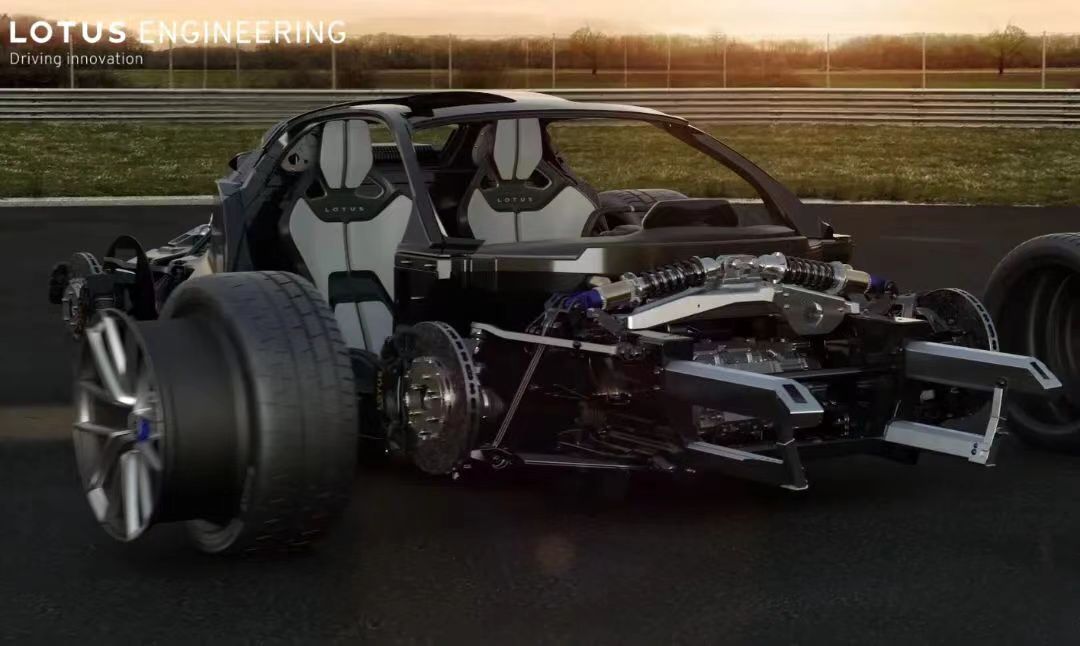

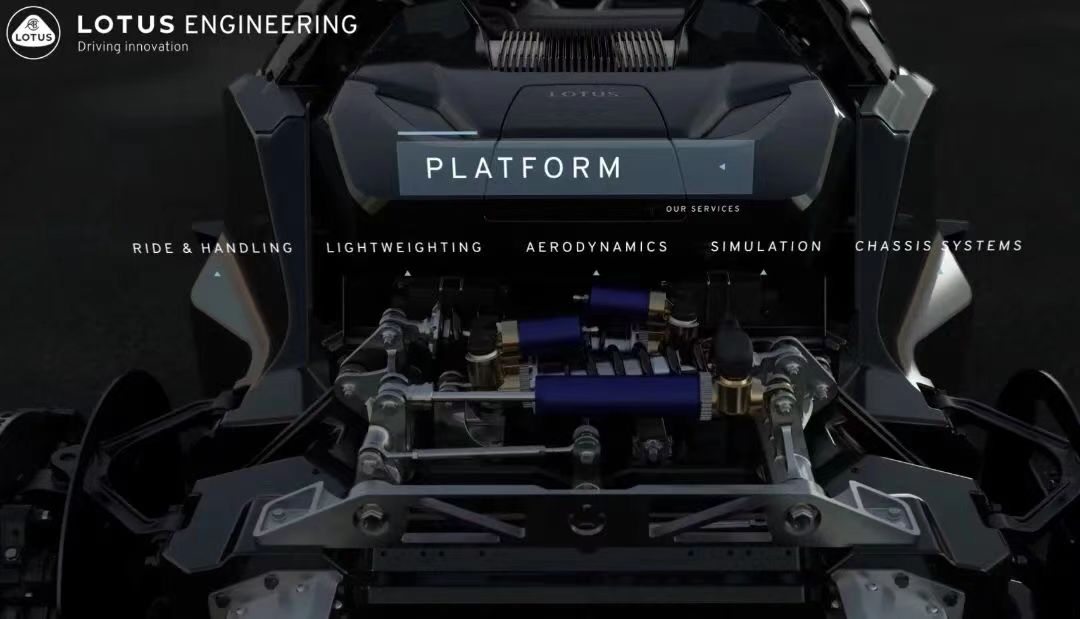

Its core

technology is their proud aerodynamics, lightweight and chassis tuning

"champion three-piece suit". And with almost every major car

manufacturer from around the world, have carried out a variety of projects.

According to some authoritative experts, more than 60% of the world's

automobile manufacturers have applied the technology from Roadster to varying

degrees.

Under the wave of

transformation of the automobile industry, many domestic new energy vehicle

enterprises have announced the discontinuation of production. Although the

industry is in a downturn, but the industry and capital will not hesitate to

wait and see, the capital will just be more cautious, the future has a healthy

and sustainable business model of the enterprise to open the door, in the logic

of the capital, the rationality of business, innovation is the core value and

investment focus. In the logic of capital, business rationality and innovation

are the core value and focus of investment. According to the law and direction

of the economy, the more depressed the environment is, the easier it is for

enterprises to rebound. The successful listing of Louts has undoubtedly

inspired the confidence of many other companies that are preparing to go public

in the U.S. to a certain extent.

With no one to

lead the way, no established rules, and no one to follow, Louts was able to

sprint toward its clear goal with unwavering conviction, and eventually went

public. This is further proof that the market will not let down the efforts of

a brand with real commercial value. The fact that Louts was finally able to

land on the NASDAQ through the SPAC model was, of course, also due to its own

professional listing consultant think tank, which helped it to quickly raise

large-scale capital and successfully go public.

The reason why Louts

went to such great lengths to go public was to obtain a large amount of

investment, which in turn would help the brand realize its vision of becoming a

leader in the electric vehicle market. Louts CEO Feng Qingfeng believes that it

is more important to feel the user's "heartbeat" than to listen to

the engine's roar. We expect other Chinese companies to take the

"heartbeat of the user" as their starting point, polish their strong

competitive advantages, and eventually grow into a company with long-term

investment value, knocking on the door of capital!

关注官方微信

关注官方微信