Bladder cancer is one of the ten most

common tumors in the body, which cannot be completely cured, and the survival rate of early-stage bladder cancer is generally more than 70%. The survival

rate in the middle and late stages is about 10%. Due to the high recurrence

rate, treatment options are relatively limited, and the number of patients is

huge, reaching 725,000 in America alone. Therefore, there is a huge unmet need

for treatment in bladder cancer, and there is a lot of room for an effective

treatment. According to Evaluate Pharma, the global bladder cancer treatment

market will reach $9.9 billion by 2028.

On January 25, 2024, CG Oncology (Stock

code: CGON.US) rang the bell on the Nasdaq. The company opened its first day of

trading at $29, and after the first day of trading, its stock continued to

rise, closing up 95.63% at $37.17 per share. The stock was priced at $19,

compared with its previous range of $16 to $18. The sale of 20 million shares raised a total of $380 million. The company's latest market value is now $2.899 billion.

It is worth noting that the $380 million

raised through the IPO is not only double the planned size ($180 million), but

also the largest IPO of a biomedicine company since May 2023, far exceeding

market expectations.

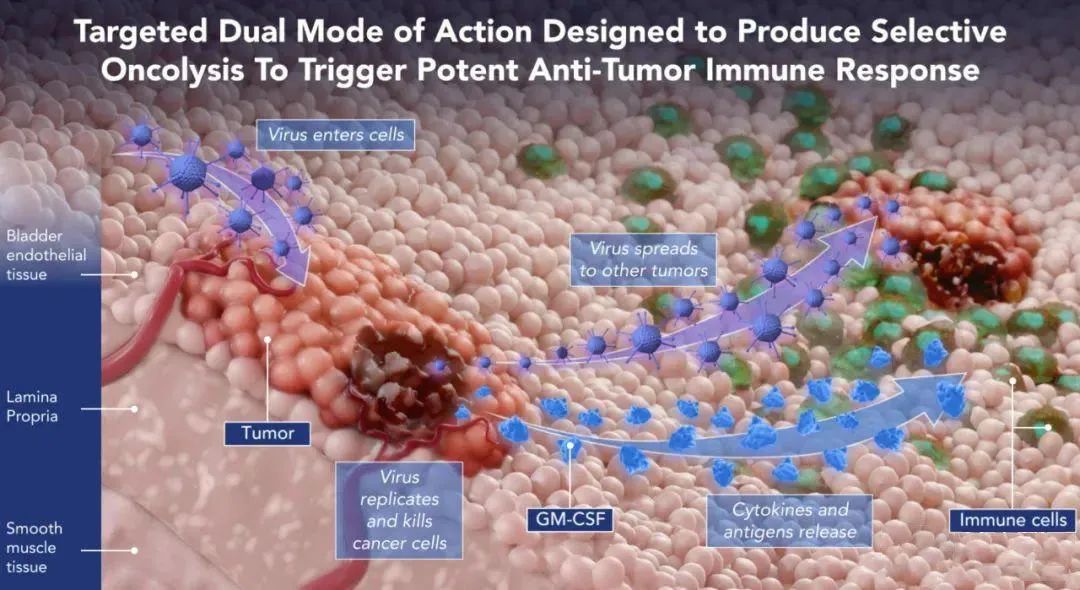

CG Oncology, founded in 2010 by Dr. Paul

DeRidder, is an American biotechnology company focused on developing oncolytic

immunotherapies for bladder cancer. The therapy, once considered a

"milestone" in cancer treatment, has repeatedly stumbled in more than

70 years of clinical exploration, with only five oncolytic virus products

currently on the market worldwide.

The company's core drug, CG0070, received

Breakthrough therapy approval and fast track status from the FDA on December 5,

2023. As reported in Science magazine that day, Omed Moaven, a surgical

oncologist at Louisiana State University Medical Center, said, more data is

needed to confirm the efficacy and safety of Cretostimogene Grenadenorepvec, but

even the positive Phase 3 trial results are enough to "shake up the world

of oncolytic viruses." The drug is currently in the phase 3 clinical

stage, and the market value of this single pipeline product has exceeded 10

billion yuan.

CG Oncology received multiple rounds of

financing before its establishment, with a total of more than $300 million.

According to data tracked by the Biopharma

Dive database, there have been more than 100 biotech IPOs in more than three

years, and CG Oncology has been sought after by the market precisely because of

its strength to stand out in the field. The company's CEO Authur Kuan once said

in an interview in 2023 that "we have been doing only one thing for more

than a decade".

Going public is a long and complicated process, but CG Oncology went from filing to listing in less than three months. The reason why CG Oncology was able to list on Nasdaq so quickly is because the company has a very clear goal and its consistent efforts to achieve it. To become the largest and most popular biopharmaceutical IPO in the past six months.

关注官方微信

关注官方微信