Warm congratulations American General Business Association Vice-Chairman, “The Godfather of SPACs in Asia”—Mr. Jason Wong incorporated a Special Purpose Acquisition Company (SPAC) —the Keen Vision Acquisition Corporation (KVAC) with other investors on February 9, 2023 (New York EST). KVAC has filed an S-1 Form with the U.S. Securities and Exchange Commission (SEC) to raise $130 million in an initial public offering on Nasdaq. The target business of SPAC company is mainly concentrated in Korean businesses. Mr. Jason Wong was invited to inspect the business in Korea on 2.15

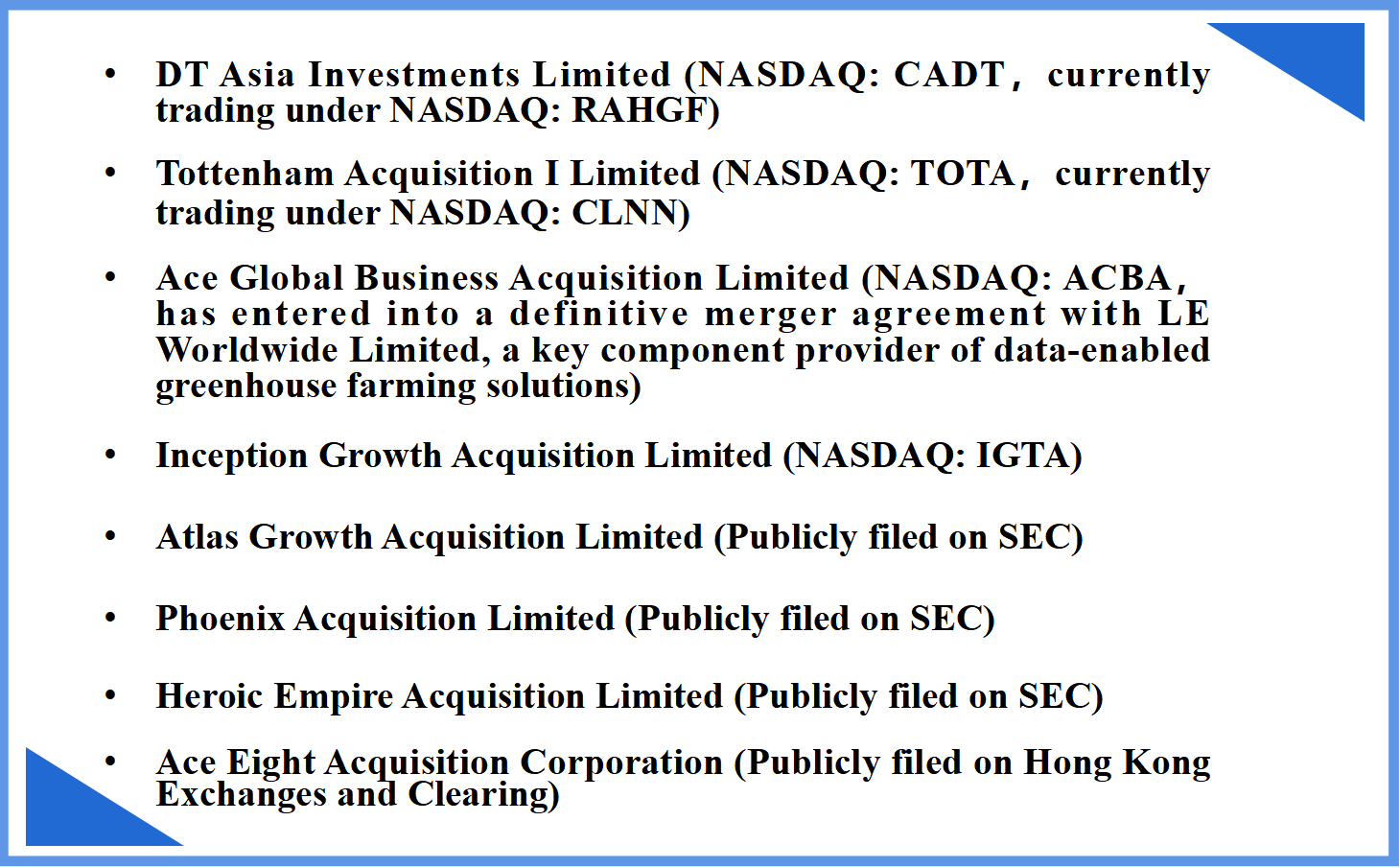

Mr. Jason Wong has been the pioneer for Asian SPAC listing in the US since 2014, participated in and launched the first Asian SPAC-DT Asia. He has strong reputation and extensive experience in SPAC initiation and M&A transaction, fund investment, cross-border M&A, project operations, value creation, exit, etc. Mr. Jason Wong has served as a sponsor, advisor or a member of the management team of several SPACs listed in the US/ Hong Kong or in the pipeline for listing since 2014, including but not limited to:

With over 25 years of experience in fund management, private equity and capital market investment in Asia, Mr. Jason Wong boasts a strong track record of successful De-SPAC transactions (SPAC reverse mergers) , thus he is hailed as “The Godfather of SPACs in Asia”by the media. At the beginning of the opening of the SPAC listing channel in 2022, the Hong Kong Stock Exchange specially invited Mr. Jason Wong to issue legal reference opinions on the warrant rules. Mr. Jason Wong currently serves as the Founder and Managing Director of Norwich Capital Limited, is the member of the AICPA and HKICPA, and serves on the board of directors of several public companies.

At present, due to the excellent performance of Korean enterprises, the business of Korean enterprises is favored by American investors. KVAC intends to focus the target business on Korea, mainly in the following areas: Biotechnology, Consumer goods, Agriculture. KVAC’s investment team has a professional background and impressive track record; and the consulting and management team are founded on rich knowledge and a strong background in the target industry sector; furthermore, its sponsors have accumulated many years of extensive experience in SPACs with high growth potential and numerous successful De-SPACs.

These establish a solid foundation for KVAC in identifying opportunities towards a successful business combination. Therefore, KVAC is confident in its ability of a qualitative business combination and pledges to fully commit to help the target company achieve development by leaps and bounds after an IPO.

Believe that Mr. Jason Wong's trip of Korea will lead the eyes of American investors to Korea, and greatly help Korean enterprises enter the US capital market through SPAC model!

关注官方微信

关注官方微信